Filing your Annual Return for your Canadian Federal Corporation

IMPORTANT: This post is specific to Canada. If you are not a Canada business/taxpayer then it is probably not applicable to you.

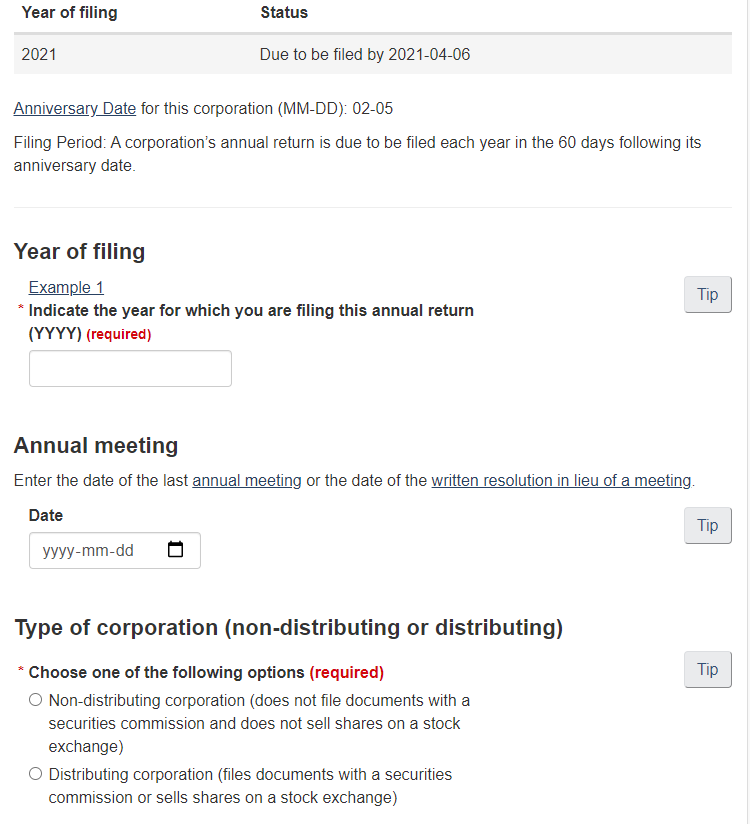

If you have a corporation registered Federally (under the Canada Business Corporations Act) rather than Provincially then you need to file an Annual Return with Corporations Canada (a division of Innovation, Science and Economic Development Canada). Each return is due within 60 days of your registration anniversary date (of our incorporation, which is probably not the same as your financial year end). This form has nothing to do with CRA or your taxes – it is a “secretarial” function of having a company. It needs to be filed by a Director or Officer of the company. It is filed online and only takes a couple of minutes and costs (at the time of writing) $12.

Here is what you need to know to complete this form:

- Year of filing is listed further up on the page. It will probably be the current calendar year (e.g., “2021”). If your anniversary date is in December you may be filling this out in the next year, so use the year from Dec.

- Annual meeting is most likely the date you approved your most recent year-end financial statements. If you had an Annual General Meeting then use this date. If you signed a resolution or minute in lieu of an AGM then use this date. If you didn’t do either then use the date that your accountant sent you the final account for your most recently completed year end. You should have had an AGM (or resolution) within 18 months after a corporation comes into existence, and then not later than 15 months after holding the last annual meeting. If you have not yet had an AGM because it is less than 18 months since you were incorporated you can leave this field blank.

- Type of corporation will be “non-distributing corporation” for most private corporations. You are only a “distributing corporation” if you are public company or issue public securities.

- Number of shareholders (will only show once you have clicked “Non-distributing corporation”) is usually “50 or fewer shareholders” for the vast majority of private corporations.

Once you have filed the Annual Return online you will be prompted to pay by credit card. You should also print and sign a copy of the Annual Return and keep it with your corporate records (which should include your minutes from your Annual General Meeting or Resolutions).