Amortzing Prepaid Expenses over the year

Sometimes it’s cheaper (or you have no choice) to pay for recurring expenses (such as insurance or software subscriptions annually rather than monthly. Now this can mess up your cash flow a bit, but if you plan it right you can get both the savings and a smooth cash flow (see my Top 10 Tips to Save Money on your Software Subscriptions article).

A question we often get asked is “how do I get my accounting system to spread the expense out over the year even though I pay once a year?”

Here are the steps to do this in Xero (you can do the same in most accounting systems):

1. Create an account in your Chart of Accounts called “Prepaid Expenses” (current asset) if you don’t already have one.

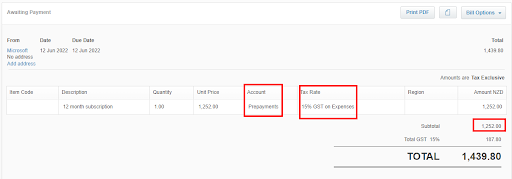

2. Create a Bill or Spend Money transaction for the annual payment. Code it to the Prepaid Expenses account. Make sure that you code the sales tax correctly if you’re in a GST/VAT country as you can claim it all back now.

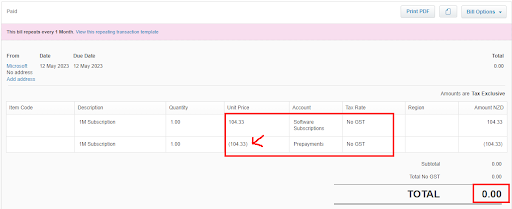

3. Next, create a Bill (accounts payable invoice) for 1/12th the annual amount (excluding tax, and don’t put any tax in this transaction) - round DOWN to the nearest cent.

- The bill will have a net zero balance and two lines.

- The first line will be to record the monthly expenses (code to the actual expense account, e.g., Insurance or Software Subscriptions).

- The second line will be coded to the Prepaid Expenses line with a negative amount.

- Set this as a repeating or recurring Bill for 11 more instances.

- If the annual cost doesn’t divide evenly by 12, increase the first bill so that the total of the 12 portions will match the total (in our example the monthly amount is $104.33 but the first month needs to be $104.37 as 104.33 x 12 = 1251.96 which is 4c short from our actual total of 1252.00).

- If you want to get pedantic over the part-month (assuming that the subscription starts mid-month) you can make the first month’s amortizing bill to cover the number of days left in the month, repeat 10 months for the 1/12th monthly average, and then the remainder on month 12.

Now the repeating bill will automatically amortize the prepaid balance to the correct expense account each month and the balance of the prepaid item will be fully amortized.

Here’s an example: $1439.80 annual subscription paid on 12 June 2022 including 15% GST

| Date | Less Precise | More Precise |

| 12 June 2022 |

Payment $1439.80 $1252 Software Expenses $187.80 GST |

Payment $1439.80 $1252 Software Expenses $187.80 GST |

|

12 June 2022 |

$104.37 |

$62.60 |

| 1 July 2022 | $104.33 |

$104.33 |

| 1 Aug 2022 |

$104.33 |

$104.33 |

| 1 Sept 2022 |

$104.33 |

$104.33 |

| 1 Oct 2022 |

$104.33 |

$104.33 |

| 1 Nov 2022 |

$104.33 |

$104.33 |

| 1 Dec 2022 |

$104.33 |

$104.33 |

| 1 Jan 2023 |

$104.33 |

$104.33 |

| 1 Feb 2023 |

$104.33 |

$104.33 |

| 1 Mar 2023 |

$104.33 |

$104.33 |

| 1 Apr 2023 |

$104.33 |

$104.33 |

| 1 May 2023 |

$104.33 |

$104.33 |

| 1 June 2023 | (new subscription will start here) | $41.77 (new subscription will have a part-month) |

Here’s a video walk through of the process:

EMBED VIDEO: https://youtu.be/jEAku_vzAes