The Fuel Accounting blog page

How to Make Work-from-home Work for Your Team

More companies are exploring their options when it comes to employees working remotely. There are numerous reasons for doing so: Increased worker morale, More flexibility in work schedules, Enhanced cost savings by not paying for office space. With all the benefits, it makes sense that employers are considering whether or not working from home can work for their team.

Tax Issues when moving from New Zealand to Canada

While Canada and New Zealand have much in common, the tax systems are very different. Any time you move countries you should plan before you leave and ensure that you fully understand the issues as assumptions from one country may not be valid in the other. Once you have moved there is little that can be done. Please be very careful where you get your advice from. We see many incorrect posts on internet forums. These people are often well meaning and simply telling the world what they did (or what they “got away with”).

Tax Issues when moving from Canada to New Zealand

While Canada and New Zealand have much in common, the tax systems are very different. Any time you move countries you should plan before you leave and ensure that you fully understand the issues as assumptions from one country may not be valid in the other. Once you have moved there is little that can be done. Please be very careful where you get your advice from. We see many incorrect posts on internet forums.

Hiring your first employee

Your business us growing and you’re ready to take the plung and hire an employee. Congratulations. There are a number of things that you need to think about, especially as you get started. Please also note that lows vary by Province – based on where the employment takes place (so if you are in Ontario but your employee will be in B.C.

Contractor or Employee

IMPORTANT: This post is specific to Canada. If you are not a Canada business/taxpayer then it is probably not applicable to you. It’s all the rage to hire casual or fixed-term staff as “contractors” and not put them on payroll. This is often advantageous to the employer because you avoid expensive things like payroll taxes, workers comp, holiday pay or annual leave, tax withholdings, statutory holiday pay, sick leave, termination criteria, personal grievances etc.

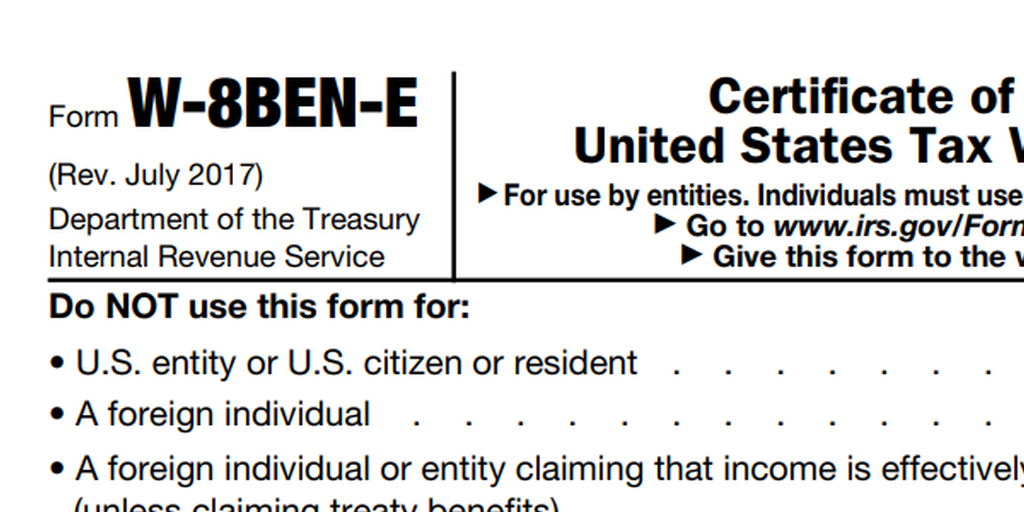

How do I complete the U.S. W-8BEN-E form?

If you’re a Canadian or Kiwi business and you work with customers in the US it probably won’t be long until someone asks you to complete a version of form W-8. In fact, they all should ask you to complete it, but many don’t know of it’s existence. The form is part of the wide-reaching U.S. FACTA requirements designed to help detect money-laundering and terrorism financing, but also imposes steep withholding taxes on non-US businesses.

5 Xero Mistakes Business Owners Make and How To Avoid Them

If you’ve just started working with Xero, it is normal to make a few mistakes while you’re learning. We see mistakes that are quite common – and unfortunately costly – so you should be aware of them if you want to get the most out of Xero’s powerful cloud accounting system. Not connecting all the bank and credit card accounts dedicated for your business.

Do I need to have an Annual Meeting for my Corporation?

Yes you do. If your business is incorporated then you are required to have at least one meeting a year of your shareholders. It’s typically called the Annual General Meeting (AGM) and it has a few things that you have to do at it: Receive the financial statements of the corporation, signed by the Directors,

Appoint an auditor, or decide not to appoint an auditor for the coming year, Approval of the minutes of the last shareholders meeting (if applicable).

Filing your Annual Return for your Canadian Federal Corporation

IMPORTANT: This post is specific to Canada. If you are not a Canada business/taxpayer then it is probably not applicable to you. If you have a corporation registered Federally (under the Canada Business Corporations Act) rather than Provincially then you need to file an Annual Return with Corporations Canada (a division of Innovation, Science and Economic Development Canada).

Leveraging Ecommerce to innovate and transform your services

We know small business owners are at varying points on the technology spectrum. Some have embraced technology to operationalize a majority of their operations while others have continued to manage with minimal technology intervention for a variety of reasons. The onset of the COVID-19 pandemic is altering the business landscape and is accelerating how businesses leverage technology to provide services and or products to clients.